UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | |

| þ | Preliminary Proxy Statement |

| | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| o | Definitive Proxy Statement |

| | |

| o | Definitive Additional Materials |

| | |

| o | Soliciting Material under §240.14a-12 |

WEAVE COMMUNICATIONS, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| | |

| þ | No fee required. |

| | |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PRELIMINARY COPY DATED MARCH 31, 2023 – SUBJECT TO COMPLETION

April , 2023

To Our Stockholders:

You are cordially invited to attend the 2023 Annual Meeting of Stockholders, or the Annual Meeting, of Weave Communications, Inc. The Annual Meeting will be held at 1331 W Powell Way, Lehi, Utah 84043 on , May , 2023 at Eastern Time.

The matters expected to be acted upon at the Annual Meeting are described in the accompanying Notice of Annual Meeting of Stockholders and proxy statement. The Annual Meeting materials include the notice, the proxy statement, our annual report and the proxy card, each of which is enclosed.

Please use this opportunity to take part in our affairs by voting on the business to come before the Annual Meeting. You will receive a Notice of Internet Availability of Proxy Materials, or the Notice, which we expect to mail on or about April , 2023, unless you have previously requested to receive our proxy materials in paper form. Our board of directors has fixed the close of business on March , 2023 as the record date for the Annual Meeting, or the Record Date, and only stockholders of record as of the Record Date may vote at the Annual Meeting and any postponements or adjournments of the meeting. All stockholders are cordially invited to participate in the Annual Meeting and any postponements or adjournments of the meeting. However, to ensure your representation at the Annual Meeting, please vote as soon as possible by using the internet or telephone, as instructed in the Notice. Alternatively, you may follow the procedures outlined in the Notice to request a paper proxy card to submit your vote by mail. Returning the paper proxy card or voting electronically does NOT deprive you of your right to attend and vote your shares on the matters acted upon at the meeting. Your vote is important. All stockholders are cordially invited to attend the Annual Meeting in person. Whether or not you expect to attend and participate in the Annual Meeting, please vote as soon as possible by submitting your proxy electronically via the Internet or by telephone by following the instructions in the Notice or if you asked to receive the proxy materials in paper form, please complete, sign and date the proxy card and return it in the postage paid envelope provided.

Sincerely,

Brett White

Chief Executive Officer

| | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON MAY , 2023: THE PROXY STATEMENT, PROXY CARD AND ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2022 ARE AVAILABLE FREE OF CHARGE AT WWW.INVESTORVOTE.COM. |

WEAVE COMMUNICATIONS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

April , 2023

| | | | | | | | |

Time and Date: | , May , 2023 at Eastern Time. |

| |

Place: | The Annual Meeting will be held on , May , 2023 at Eastern Time at 1331 W Powell Way, Lehi, Utah 84043. |

| |

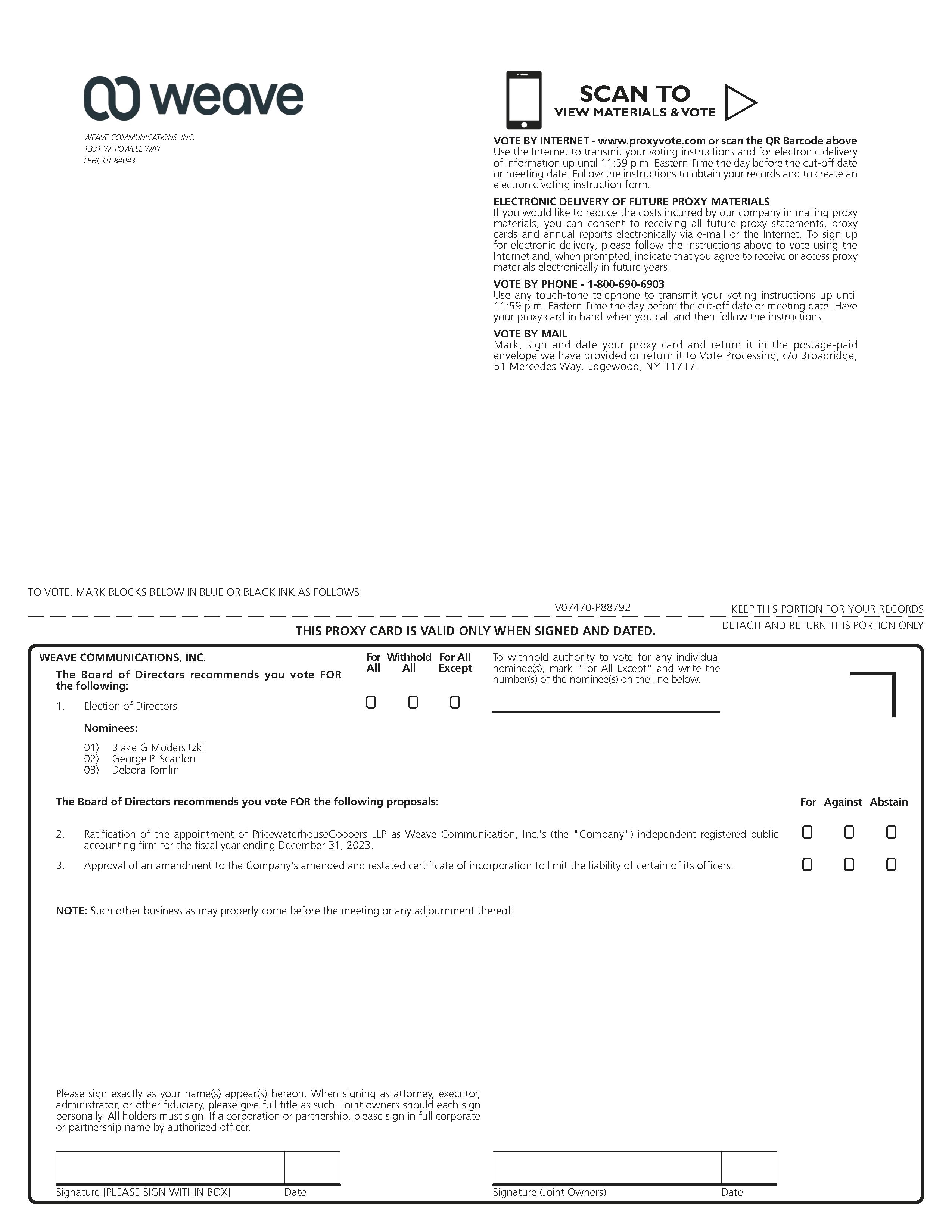

Items of Business: | 1. | Elect the three Class II directors listed in the accompanying proxy statement, each to serve a three-year term expiring at the 2026 annual meeting of stockholders or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal. |

| | |

| 2. | Ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of Weave Communications, Inc. for the fiscal year ending December 31, 2023. |

| | |

| 3. | Approve an amendment to Weave Communications, Inc.’s amended and restated certificate of incorporation to limit the liability of certain of its officers as permitted by recent amendments to the General Corporation Law of the State of Delaware. |

| | |

| 4. | Transact any other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

| | |

Record Date: | Only stockholders of record at the close of business on March , 2023 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments thereof. |

| |

Proxy Voting: | Each share of common stock that you own represents one vote. |

| |

| For questions regarding your stock ownership, you may contact us through our Investor Relations section of our website at https://investors.getweave.com/investor-resources/contact-ir or, if you are a registered holder, contact our transfer agent, Computershare Trust Company, N.A., through its website at www.computershare.com or by phone at (800) 736-3001. |

By Order of the Board of Directors,

| | | | | |

| |

Brett White

Chief Executive Officer | Stuart C. Harvey Jr. Chairperson of the Board |

WEAVE COMMUNICATIONS, INC.

PROXY STATEMENT FOR 2023 ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

Page

| | | | | |

Participation in our Initial Public Offering | # |

Employment of Related Person | # |

Right of First Refusal | # |

| |

| |

| |

| |

| |

| |

| |

| |

WEAVE COMMUNICATIONS, INC.

________________

PROXY STATEMENT FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON WEDNESDAY, MAY 24, 2023

________________

APRIL , 2023

Information About Solicitation and Voting

The accompanying proxy is solicited on behalf of our board of directors of Weave Communications, Inc. for use at Weave Communications’ 2023 Annual Meeting of Stockholders (the "Annual Meeting" or “meeting”) to be held on , May , 2023 at Eastern Time at 1331 W Powell Way, Lehi, Utah 84043. References in the proxy statement for the Annual Meeting, or the Proxy Statement, to “we,” “us,” “our,” the “Company” or “Weave Communications” refer to Weave Communications Inc.

Internet Availability of Proxy Materials

We will mail, on or about April , 2023, the Notice of Internet Availability of Proxy Materials, or the Notice, to our stockholders of record and beneficial owners at the close of business on March , 2023. On the date of mailing of the Notice, all stockholders and beneficial owners will have the ability to access all of the proxy materials on a website referred to in the Notice. These proxy materials will be available free of charge.

The Notice will identify the website where the proxy materials will be made available; the date, the time and location of the Annual Meeting; the matters to be acted upon at the meeting and our board of directors’ recommendations with regard to each matter; a toll-free telephone number, an e-mail address, and a website where stockholders can request a paper or e-mail copy of the Proxy Statement; our Annual Report on Form 10-K for the year ended December 31, 2022, or our Annual Report, and a form of proxy relating to the Annual Meeting; information on how to access the form of proxy; and information on how to participate in the meeting and vote in person.

Questions and Answers About the Meeting and Related Topics

Q: What is included in these materials?

A: These materials include.

•The Proxy Statement; and

•The Company’s Annual Report on Form 10-K for the year ended December 31, 2022, or the Annual Report, as filed with the Securities and Exchange Commission, or the SEC, on March 16, 2023.

Q: What is the purpose of the meeting?

A: At the meeting, stockholders will act upon the proposals described in this proxy statement. In addition, following the formal portion of the meeting, management will be available to respond to questions from stockholders.

Q: What proposals are scheduled to be voted on at the meeting?

A: Stockholders will be asked to vote on the following three proposals at the meeting:

1.to elect Blake G Modersitzki, George P. Scanlon and Debora Tomlin as Class II directors to serve for a term of three years or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal;

2.to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and

3.to approve an amendment to our amended and restated certificate of incorporation to limit the liability of certain of our officers as permitted by recent amendments to the General Corporation Law of the State of Delaware.

Q: Could matters other than Proposals One, Two, and Three be decided at the meeting?

A: Our bylaws require that we receive advance notice of any proposal to be brought before the meeting by stockholders of Weave Communications, and we have not received notice of any such proposals. If any other matter were to come before the meeting, the proxy holders appointed by our board of directors will have the discretion to vote on those matters for you.

Q: How does the board of directors recommend I vote on these proposals?

A: Our board of directors recommends that you vote your shares:

•“FOR ALL” the nominees to the board of directors (Proposal One);

•“FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal Two); and

•“FOR” the amendment to our amended and restated certificate of incorporation to limit the liability of certain of our officers as permitted by recent amendments to the General Corporation Law of the State of Delaware (Proposal Three).

Q: Who may vote at the Annual Meeting?

A: Stockholders of record as of the close of business on March , 2023, or the Record Date, are entitled to receive notice of, to attend and participate, and to vote at the Annual Meeting. At the close of business on the Record Date, there were shares of our common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the stockholder of record with respect to those shares, and these proxy materials will be sent directly to you by Weave Communications.

Beneficial Owner of Shares Held in Street Name: Shares Registered in the Name of a Broker or Nominee

If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the “beneficial owner” of shares held in “street name,” and these proxy materials will be forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. Because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a legal proxy from the organization that holds your shares giving you the right to vote the shares at the Annual Meeting.

Q: How do I attend the Annual Meeting?

A: The Annual Meeting will be a meeting of stockholders to be held on May , 2023 at 1331 W Powell Way, Lehi, Utah 84043. The meeting will begin promptly at Eastern Time. We encourage you to arrive at the venue prior to the start time and you should allow ample time for the check-in procedures.

Q: What should I bring to check in at the Annual Meeting?

A: All persons attending the Annual Meeting will be required to present a current form of government-issued picture identification. If you are a stockholder of record and attend the Annual Meeting, you may vote by ballot in person even if you have previously voted on a proxy card. If you hold shares beneficially in street name and wish to attend the Annual Meeting and vote in person, you must provide a “legal proxy” from your bank, broker or other nominee and proof of ownership on the Record Date (such as a recent brokerage statement) or the voting instruction form mailed to you by your bank, broker or other nominee. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

Q: How can I vote my shares in person at the Annual Meeting?

A. You may attend the Annual Meeting on May , 2023, at Eastern Time at 1331 W Powell Way, Lehi, Utah 84043. Shares held in your name as the stockholder of record may be voted at the Annual Meeting. Shares held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares. See below for more details. Even if you plan to attend the Annual Meeting, we urge you to also vote by returning a proxy card or by submitting your proxy or voting

instructions as described below so that your vote will be counted if you later decide not to attend the Annual Meeting.

Q: How do I vote my shares without attending the Annual Meeting?

A. Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a stockholder of record, you may vote by signing and returning the envelope provided with the proxy card. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your brokerage firm, bank, broker-dealer, trust, or other similar organization or other holder of record. You may vote by mail or follow any other alternative voting procedure (such as telephone or internet voting) described on your Notice. To use an alternative voting procedure, follow the instructions on each voting instruction form and/or proxy card that you receive. The alternative voting procedures are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may:

•vote by telephone or through the internet – in order to do so, please follow the instructions shown on your Notice or proxy card; or

•vote by mail – if you request or receive a paper proxy card or voting instructions by mail, simply complete, sign and date the enclosed proxy card and return it before the meeting in the pre-paid envelope provided.

Votes submitted by telephone or through the internet must be received by 11:59 p.m. Eastern Time, on May , 2023. If you vote by mail, your proxy card must be received by May , 2023. Submitting your proxy, whether by telephone, through the internet or by mail if you request or receive a paper proxy card, will not affect your right to vote in person should you decide to attend and participate in the meeting in person.

Beneficial Owner: Shares Registered in the Name of a Broker or Other Nominee

If you are not the stockholder of record, please refer to the voting instructions provided by your nominee to direct it how to vote your shares. Your vote is important. To ensure that your vote is counted, complete and mail the voting instruction form provided by your brokerage firm, bank, or other nominee as directed by your nominee. To vote in person at the Annual Meeting, you must obtain a legal proxy from your nominee. Follow the instructions from your nominee included with our proxy materials or contact your nominee to request a proxy form.

Your vote is important. Whether or not you plan to participate in the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted.

Q: How do I vote by internet or telephone?

A. If you wish to vote by internet or telephone, you may do so by following the voting instructions included on your Notice or proxy card or voting instruction form. Please have each Notice or

proxy card or voting instruction form you received in hand when you vote over the internet or by telephone as you will need information specified therein to submit your vote. The giving of such a telephonic or internet proxy will not affect your right to vote in person (as detailed above) should you decide to attend the meeting.

The telephone and internet voting procedures are designed to authenticate stockholders' identities, to allow stockholders to give their voting instructions and to confirm that stockholders' instructions have been recorded properly.

Q: What shares can I vote?

A: Each share of Weave Communications common stock issued and outstanding as of the close of business on March , 2023 is entitled to vote on all items being voted on at the meeting. You may vote all shares owned by you as of March , 2023, including (1) shares held directly in your name as the stockholder of record, and (2) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee.

Q: How many votes am I entitled to per share?

A: Each holder of shares of common stock is entitled to one vote for each share of common stock held as of March , 2023.

Q: What is the quorum requirement for the meeting?

A: The holders of a majority of the voting power of the shares of our common stock entitled to vote at the Annual Meeting as of the Record Date must be present in person or represented by proxy at the Annual Meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Annual Meeting if you are present and vote in person at the Annual Meeting or if you have properly submitted a proxy.

Q: How are abstentions and broker non-votes treated?

A: Abstentions (i.e., shares present at the Annual Meeting and marked “abstain”) are deemed to be shares presented or represented by proxy and entitled to vote, and are counted for purposes of determining whether a quorum is present. Abstentions have no effect on Proposal Two. Abstentions have the same effect as votes AGAINST Proposal Three.

A broker non-vote occurs when the beneficial owner of shares fails to provide the broker, bank or other nominee that holds the shares with specific instructions on how to vote on any "non-routine" matters brought to a vote at the stockholders meeting. In this situation, the broker, bank or other nominee will not vote on the “non-routine” matter. Broker non-votes are counted for purposes of determining whether a quorum is present and have no effect on Proposal One or Proposal Two. Broker non-votes have the same effect as votes AGAINST Proposal Three.

Note that if you are a beneficial holder, brokers and other nominees will be entitled to vote your shares on “routine” matters without instructions from you. The only proposal that would be considered “routine” in such event is the proposal for the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal

year ending December 31, 2023 (Proposal Two). A broker or other nominee will not be entitled to vote your shares on any “non-routine” matters, absent instructions from you. “Non-routine” matters include proposals other than Proposal Two, such as the election of directors and the charter amendment. Accordingly, we encourage you to provide voting instructions to your broker or other nominee whether or not you plan to attend the meeting.

Q: What is the vote required for each proposal?

A: The votes required to approve each proposal are as follows:

•Proposal One: Each director nominee must be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors, meaning that the three individuals nominated for election to our board of directors at the Annual Meeting receiving the highest number of “FOR” votes will be elected. If you "WITHHOLD” your vote, it will have no effect on the election of directors.

•Proposal Two: Approval will be obtained if the number of votes cast “FOR” the proposal at the Annual Meeting exceeds the number of votes “AGAINST” the proposal.

•Proposal Three: Approval will be obtained with the affirmative vote “FOR” the proposal of the holders of a majority of our outstanding common stock entitled to vote at the Annual Meeting.

Q: If I submit a proxy, how will it be voted?

A: When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted in accordance with the recommendations of our board of directors as described above. If any matters not described in the Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is postponed or adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy instructions, as described below under “Can I change my vote or revoke my proxy?”

Q: What should I do if I get more than one proxy card or voting instruction form?

A: Stockholders may receive more than one set of voting materials, including multiple copies of the proxy materials and multiple Notices, proxy cards or voting instruction forms. For example, stockholders who hold shares in more than one brokerage account may receive separate sets of proxy materials or one Notice for each brokerage account in which shares are held. Stockholders of record whose shares are registered in more than one name will receive more than one set of proxy materials. You should vote in accordance with all of the proxy cards and voting instruction forms you receive relating to our Annual Meeting to ensure that all of your shares are voted and counted.

Q: Can I change my vote or revoke my proxy?

A: You may change your vote or revoke your proxy at any time prior to the taking of the vote or the polls closing at the Annual Meeting.

If you are the stockholder of record, you may change your vote by:

•granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (and until the applicable deadline for each method);

•providing a written notice of revocation to our Corporate Secretary at Weave Communications, Inc., 1331 W Powell Way, Lehi, Utah 84043, prior to your shares being voted, or

•attending the Annual Meeting and voting in person at the meeting. Attendance alone at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically vote during the meeting.

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Q. How can I get electronic access to the proxy materials?

A: Your Notice will provide you with instructions regarding how to:

•view our proxy materials for the meeting through the internet; and

•instruct us to send our future proxy materials to you electronically by email.

If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

Q: Is there a list of stockholders entitled to vote at the Annual Meeting?

A: The names of stockholders of record entitled to vote will be available for inspection during the Annual Meeting at 1331 W Powell Way, Lehi, Utah 84043. In addition, for ten (10) days prior to the meeting, the names of stockholders of record entitled to vote will be available for inspection by stockholders of record for any purpose germane to the meeting between the hours of 9:00 a.m. and 5:00 p.m., local time, at our offices located at 1331 W Powell Way, Lehi, Utah 84043. If you are a stockholder of record and want to inspect the stockholder list, please send a written request to our Corporate Secretary at Weave Communications Inc., 1331 W Powell Way, Lehi, Utah 84043, or email ir@getweave.com to arrange for electronic access to the stockholder list.

Q: Who will tabulate the votes?

A: A representative of Broadridge Financial Solutions, Inc. will serve as the Inspector of Elections and will tabulate the votes at the Annual Meeting.

Q: Where can I find the voting results of the Annual Meeting?

A: We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting.

Q: I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

A: The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process is commonly referred to as “householding.”

Brokers with account holders who are Weave Communications stockholders may be householding our proxy materials. A single set of proxy materials may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you notify your broker or Weave Communications that you no longer wish to participate in householding.

If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement and annual report, you may (1) notify your broker, (2) direct your written request to: Investor Relations, Weave Communications, Inc., 1331 W Powell Way, Lehi, Utah 84043 or (3) contact our Investor Relations department by email at ir@getweave.com or by telephone at (385) 336-5493. Stockholders who currently receive multiple copies of the proxy statement or annual report at their address and would like to request householding of their communications should contact their broker. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the annual report and proxy statement to a stockholder at a shared address to which a single copy of the documents was delivered.

Q: What if I have questions about my Weave Communications shares or need to change my mailing address on my stockholder account?

A: You may contact our transfer agent, Computershare Trust Company, N.A., by telephone at (800) 736-3001, through its website at www.computershare.com or by U.S. mail at 462 South 4th Street, Suite 1600, Louisville, KY 40202, if you have questions about your Weave Communications shares or need to change your mailing address on your stockholder account.

Q: Who is soliciting my proxy and paying for the expense of solicitation?

A: The proxy for the Annual Meeting is being solicited on behalf of our board of directors. We will pay the cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. We may, upon request, reimburse brokerage firms and other nominees for their expenses in forwarding proxy materials to beneficial owners. In addition to soliciting proxies by mail, we expect that our directors, officers and employees may solicit proxies in person or by telephone or facsimile. None of these individuals will receive any additional or special compensation for doing this, although we may reimburse these individuals for their reasonable out-of-pocket expenses. We do not expect to, but have the option to, retain a proxy solicitor. If you choose to access the proxy materials or vote via the internet or by phone, you are responsible for any internet access or phone charges you may incur.

Q: What are the requirements to propose actions to be included in our proxy materials for next year’s annual meeting of stockholders, or our 2024 Annual Meeting, or for consideration at our 2024 Annual Meeting?

A: Requirements for Stockholder Proposals to be considered for inclusion in our proxy materials for our 2024 Annual Meeting:

Our amended and restated bylaws provide that stockholders may present proposals for inclusion in our proxy statement by submitting their proposals in writing to the attention of our Corporate Secretary at our principal executive office. Our current principal executive office is located at 1331 W Powell Way, Lehi, Utah 84043. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and related SEC regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. In order to be included in the proxy statement for our 2023 Annual Meeting, stockholder proposals must be received by our Corporate Secretary no later than December , 2023 and must otherwise comply with the requirements of Rule 14a-8 of the Exchange Act. If we do not receive a stockholder proposal by the deadline described above, we may exclude the proposal from our proxy statement for our annual stockholder meeting to be held in 2023.

Requirements for Stockholder Proposals to be presented at our 2024 Annual Meeting:

Our amended and restated bylaws provide that stockholders may present proposals to be considered at an annual meeting by providing timely notice to our Corporate Secretary at our principal executive office. To be timely for our 2023 Annual Meeting, our Corporate Secretary must receive the written notice at our principal executive office:

•not earlier than the close of business on January , 2023, and

•not later than the close of business on February , 2023.

If we hold our 2024 annual meeting of stockholders more than 30 days before or more than 60 days after May , 2024 (the one-year anniversary date of the Annual Meeting), then notice of a stockholder proposal that is not intended to be included in our proxy statement must be received by our Secretary at our principal executive office:

•not earlier than the close of business on the 120th day prior to such annual meeting, and

•not later than the close of business on the later of (i) the 90th day prior to such annual meeting, or (ii) the tenth day following the day on which public announcement of the date of such annual meeting is first made.

Additionally, our stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must comply with the additional requirements of Rule 14a-19(b) under the Exchange Act.

A stockholder’s notice to our Corporate Secretary must set forth as to each matter the stockholder proposes to bring before the annual meeting the information required by our amended and restated bylaws. If a stockholder who has notified Weave Communications of such stockholder’s intention to present a proposal at an annual meeting does not appear to present such stockholder’s proposal at such meeting, Weave Communications does not need to present the proposal for vote at such meeting.

Q: How can I elect to receive my proxy materials electronically by email?

A: Registered stockholder (i.e., you hold your shares through our transfer agent, Computershare) – To receive future copies of our proxy materials by email, registered stockholders should go to www.proxyvote.com and follow the enrollment instructions. Upon completion of enrollment, you will receive an email confirming the election to use the online services. The enrollment in the online program will remain in effect until the enrollment is cancelled.

Beneficial stockholders (i.e., you hold your shares through an intermediary, such as a bank or broker) – Most beneficial stockholders can elect to receive an email that will provide electronic versions of the proxy materials. To view a listing of participating brokerage firms and enroll in the online program, beneficial stockholders should go www.ProxyVote.com follow the enrollment instructions. The enrollment in the online program will remain in effect for as long as the brokerage account is active or until the enrollment is cancelled.

Enrolling to receive our future proxy materials online will save us the cost of printing and mailing documents, as well as help preserve our natural resources.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

We have a strong commitment to good corporate governance practices. These practices provide an important framework within which our board of directors, its committees and our management can pursue our strategic objectives in order to promote the interests of our stockholders.

Corporate Governance Guidelines

Our board of directors has adopted Corporate Governance Guidelines that set forth expectations for directors, director independence standards, board committee structure and functions and other policies for the governance of our company. Our Corporate Governance Guidelines are available without charge on the Investor Relations section of our website, which is located at https://investors.getweave.com by clicking on “Governance Documents” in the “Governance” section of our website. Our Corporate Governance Guidelines are subject to modification from time to time by our board of directors pursuant to the recommendations of our nominating and governance committee.

Board Leadership Structure

Our board of directors does not have a formal policy regarding the separation of the roles of Chief Executive Officer and Chairperson of the Board, as our board of directors believes that it is in the best interests of the Company to make that determination based on the direction of the Company and the current membership of the board of directors. Our board of directors has determined that having a director who is also the Chief Executive Officer serve as the Chairperson is not in the best interest of the Company’s stockholders at this time. This separation of roles enables our Chief Executive Officer to focus on his core responsibility of leading and managing our operations and day-to-day performance, consistent with strategic direction provided by our board of directors, and our Chairperson of the board of directors to focus on leading our board of directors in its fundamental role of providing guidance to, and independent oversight of, our management. Currently, Brett White serves as our Chief Executive Officer, and Stuart C. Harvey Jr. serves as Chairperson of our board of directors.

Our Board of Directors’ Role in Risk Oversight

One of the key functions of our board of directors is informed oversight of our risk management process. Although our board of directors does not have a standing risk management committee, it administers this oversight function directly through the board of directors as a whole, as well as through its standing committees that address risks inherent in their respective areas of oversight. Areas of focus include economic, operational, financial (accounting, credit, investment, liquidity and tax), competitive, legal, regulatory, cybersecurity, privacy, compliance and reputational risks, and more recently, risk exposure due to the insolvency of Silicon Valley Bank and other financial institutions. The risk oversight responsibility of our board of directors and its committees is supported by our management reporting processes, which are designed to provide visibility to our board of directors and to our personnel who are responsible for risk assessment and information about the identification, assessment and management of critical risks, and our management’s risk mitigation strategies.

Our audit committee is responsible for reviewing and discussing our financial risk management policies, including our investment policies, and our major financial, accounting, tax, and enterprise risk exposures and the steps management has taken to monitor and control such exposure. The audit committee also monitors compliance with legal and regulatory requirements and assists our board of

directors in fulfilling its oversight responsibilities with respect to risk management. Our compensation committee reviews major compensation-related risk exposures and the steps management has taken to monitor and control such exposures. Our compensation committee also assesses whether the Company’s compensation policies and practices create risks that are reasonably likely to have a material adverse effect on the Company. Our nominating and governance committee assesses risks related to our corporate governance practices, the independence of our board of directors and monitors the effectiveness of our governance guidelines.

We believe this division of responsibilities is an effective approach for addressing the risks we face and that our board leadership structure supports this approach.

Independence of Directors

New York Stock Exchange, or NYSE, listing rules generally require that a majority of the members of a listed company’s board of directors be independent. In addition, the listing rules generally require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and governance committees be independent.

In addition, audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in such member’s capacity as a member of the audit committee, the board of directors or any other board committee (i) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (ii) be an affiliated person of the listed company or any of its subsidiaries.

Our board of directors conducts an annual review of the independence of our directors by applying the independence principles and standards established by NYSE. These provide that a director is independent only if the board affirmatively determines that the director has no direct or indirect material relationship with our company. They also specify various relationships that preclude a determination of director independence. Material relationships may include commercial, industrial, consulting, legal, accounting, charitable, family and other business, professional and personal relationships.

Applying these standards, our board of directors has determined that none of the current members of our board of directors, other than Mr. White and Mr. Banks when he served as a member of our board of directors, has a relationship that would interfere with the exercise of such members’ independent judgment in carrying out their responsibilities as a director and that each of the current members of our board of directors other than Mr. White is “independent” as that term is defined under NYSE listing rules. Our board of directors has also determined that all members of our audit committee, compensation committee and nominating and governance committee are independent and satisfy the relevant SEC and NYSE independence requirements for such committees.

Committees of Our Board of Directors

Our board of directors has established an audit committee, a compensation committee and a nominating and governance committee. The composition and responsibilities of each committee are described below. Each of these committees has a written charter approved by our board of directors. Copies of the charters for each committee are available on the Investor Relations section of our website,

which is located at https://investors.getweave.com, by clicking on “Governance Documents” in the “Governance” section of our website. Members serve on these committees until (i) they resign from their respective committee, (ii) they no longer serve as a director or (iii) as otherwise determined by our board of directors.

Audit Committee

Our audit committee is composed of George P. Scanlon, who is the chair of our audit committee, Tyler Newton and David Silverman. The composition of our audit committee meets the requirements for independence under current NYSE listing rules and SEC rules and regulations. Each member of our audit committee is financially literate. In addition, our board of directors has determined that Mr. Scanlon is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K of the Securities Act of 1933, as amended, or the Securities Act. This designation does not impose any duties, obligations or liabilities that are greater than those generally imposed on members of our audit committee and our board of directors.

The primary purpose of the audit committee is to discharge the responsibilities of our board of directors with respect to oversight of our accounting and financial reporting processes, the integrity of our financial statements, our compliance with legal and regulatory requirements, the performance of our internal audit function and systems of internal control, and audits of our financial statements, and to oversee our independent registered public accounting firm. Pursuant to its charter, our audit committee, among other things:

•selects a firm to serve as the independent registered public accounting firm to audit our financial statements;

•helps to ensure the independence of the independent registered public accounting firm;

•discusses the scope and results of the audit with the independent registered public accounting firm, and reviews, with management and the independent accountants, our interim and year-end operating results;

•develops procedures for employees to anonymously submit concerns about questionable accounting or audit matters; and

•considers the adequacy of our internal accounting controls and audit procedures.

Our audit committee has a written charter approved by our board of directors. A copy of the charter is available on the Investor Relations section of our website, which is located at https://investors.getweave.com, by clicking on “Governance Documents” in the “Governance” section of our website.

Compensation Committee

Our compensation committee is composed of Blake G Modersitzki, who is the chair of our compensation committee, Tyler Newton and Debora Tomlin. The composition of our compensation committee meets the requirements for independence under current NYSE listing rules and SEC rules and regulations. Other than Mr. Modersitzki, each member of this committee is also a non-employee director,

as defined pursuant to Rule 16b-3 promulgated under the Exchange Act. The primary purpose of our compensation committee is to discharge the responsibilities of our board of directors in overseeing our overall compensation policies, plans and programs and human capital management function, and to review, determine and execute our compensation philosophy, and the compensation of our executive officers, directors, and other senior management, as appropriate. Pursuant to its charter, our compensation committee, among other things:

•reviews and determines the compensation of our executive officers and recommends to our board of directors the compensation for our directors;

•administers our stock and equity incentive plans;

•reviews and makes recommendations to our board of directors with respect to incentive compensation and equity plans; and

•establishes and reviews general policies relating to compensation and benefits of our employees.

The compensation committee may delegate its authority to a subcommittee of the compensation committee (consisting either of a subset of members of the committee or, after giving due consideration to whether the eligibility criteria described within the compensation committee charter with respect to committee members and whether such other board members satisfy such criteria, any members of the board of directors) except for its exclusive authority to determine the amount and form of compensation paid to the Chief Executive Officer.

Our compensation committee has a written charter approved by our board of directors. A copy of the charter is available on the Investor Relations section of our website, which is located at https://investors.getweave.com, by clicking on “Governance Documents” in the “Governance” section of our website.

Nominating and Governance Committee

Our nominating and corporate governance committee is composed of Tyler Newton, who is the chair of our nominating and governance committee, Stuart C. Harvey Jr. and David Silverman. The composition of the nominating and corporate governance committee meets the requirements for independence under current NYSE listing rules and SEC rules and regulations. The primary purpose of our nominating and governance committee is to discharge the responsibilities of our board of directors in ensuring that the board of directors is properly constituted to meet its fiduciary duties. Pursuant to its charter, our nominating and governance committee, among other things:

•identifies, evaluates and recommends nominees and consider and evaluate stockholder nominees for election to our board of directors and committees of our board of directors;

•conducts searches for appropriate directors;

•evaluates the performance of our board of directors and of individual directors;

•considers and makes recommendations to the board of directors regarding the composition of the board and its committees;

•reviews developments in corporate governance practices;

•evaluates the adequacy of our corporate governance practices and reporting; and

•makes recommendations to our board of directors concerning corporate governance matters.

Our nominating and governance committee has a written charter approved by our board of directors. A copy of the charter is available on the Investor Relations section of our website, which is located at https://investors.getweave.com, by clicking on “Governance Documents” in the “Governance” section of our website.

Presiding Director of Non-Employee Director Meetings

The non-employee directors meet in regularly scheduled executive sessions without management to promote open and honest discussion. The Chairperson of our board of directors, who is a non-employee and independent director, serves as the presiding director at these meetings.

Compensation Committee Interlocks and Insider Participation

The members of our compensation committee during 2022 included Messrs. Modersitzki and Newton and Ms. Tomlin. None of the members of our compensation committee in 2022 was at any time during 2022 or at any other time one of our officers or employees, other than Mr. Modersitzki, none had or have any relationships with us that are required to be disclosed under Item 404 of Regulation S-K. During 2022, none of our executive officers served as a member of the board of directors, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our board of directors or compensation committee.

In November 2021, entities affiliated with Pelion Ventures VI, L.P., a holder of more than 5% of our common stock and an affiliate of a member of our board of directors, Blake G Modersitzki, purchased approximately 400,000 shares in our initial offering public offering at our initial public offering price of $24.00 per share.

Board and Committee Meetings and Attendance

Our board of directors and its committees meet regularly throughout the year, and also hold special meetings and act by written consent from time to time. During 2022: (i) our board of directors met five (5) times; (ii) our audit committee met seven (7) times; (iii) our compensation committee met four (4) times; and (iv) our nominating and governance committee met five (5) times.

During 2022, each member of our board of directors attended at least 75% of the aggregate of all meetings of our board of directors and of all meetings of committees of our board of directors on which such member served that were held during the period in which such director served.

Board Attendance at Annual Meeting of Stockholders

Our policy is to invite and encourage each member of our board of directors to be present at our annual meetings of stockholders. All of our directors who then served on our board of directors attended the 2022 Annual Meeting of Stockholders.

Communication with Directors

Stockholders and interested parties who wish to communicate with our board of directors, non-management members of our board of directors as a group, a committee of our board of directors or a specific member of our board of directors (including our Chairperson of the board of directors) may do so by letters addressed to the attention of our Corporate Secretary.

All communications are reviewed by our Corporate Secretary and provided to the members of our board of directors as appropriate. Unsolicited items, sales materials, abusive, threatening or otherwise inappropriate materials and other routine items and items unrelated to the duties and responsibilities of our board of directors will not be provided to directors.

The address for these communications is:

Weave Communications, Inc.

1331 W Powell Way,

Lehi, Utah 84043

Attn: Corporate Secretary

Global Code of Conduct

We have adopted a Global Code of Conduct that applies to all of the members of our board of directors, officers and employees. Our Global Code of Conduct is posted on the Investor Relations section of our website, which is located at https://investors.getweave.com, by clicking on “Governance Documents” in the “Governance” section of our website. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding amendment to, or waiver from, a provision of our Global Code of Conduct by posting such information on our website at the location specified above.

NOMINATIONS PROCESS AND DIRECTOR QUALIFICATIONS

Nomination to the Board of Directors

Candidates for nomination to our board of directors are selected by our board of directors based on the recommendation of our nominating and governance committee in accordance with its charter, our amended and restated certificate of incorporation and amended and restated bylaws, our Corporate Governance Guidelines and the criteria approved by our board of directors regarding director candidate qualifications. In recommending candidates for nomination, our nominating and governance committee considers candidates recommended by stockholders, using the same criteria to evaluate all candidates.

Additional information regarding the process for properly submitting stockholder nominations for candidates for nomination to our board of directors is set forth above under “Questions and Answers About the Meeting and Related Topics — What are the requirements to propose actions to be included in our proxy materials for next year’s annual meeting of stockholders, or our 2024 Annual Meeting, or for consideration at our 2024 Annual Meeting?”

Director Qualifications

With the goal of developing an experienced and highly qualified board of directors, with a diverse background and skill set that contribute to the total mix of viewpoints and experience represented on the board of directors, our nominating and governance committee is responsible for developing and recommending to our board of directors the desired qualifications, expertise and characteristics of members of our board of directors, including any specific minimum qualifications that the committee believes must be met by a committee-recommended nominee for membership on our board of directors and any specific qualities or skills that the committee believes are necessary for one or more of the members of our board of directors to possess.

Because the identification, evaluation and selection of qualified directors is a complex and subjective process that requires consideration of many intangible factors, and will be significantly influenced by the particular needs of our board of directors from time to time, our board of directors has not adopted a specific set of minimum qualifications, qualities or skills that are necessary for a nominee to possess, other than those that are necessary to meet U.S. legal, regulatory and NYSE listing requirements and the provisions of our amended and restated certificate of incorporation and amended and restated bylaws, our Corporate Governance Guidelines and the charters of the committees of our board of directors. When considering nominees, our nominating and governance committee may take into consideration many factors including, among other things, a candidate’s independence, character, integrity, judgment diversity, professional achievements, skills, financial and other areas of expertise, breadth of experience, knowledge about our business or industry and ability to devote adequate time and effort to responsibilities of our board of directors in the context of its existing composition. Our board of directors does not have a formal policy with respect to diversity and inclusion; however, it affirms the value placed on diversity within our company. Through the nomination process, our nominating and governance committee seeks to promote board membership that reflects a diversity of business experience, expertise, viewpoints, personal backgrounds and other characteristics that are expected to contribute to our board of directors’ overall effectiveness. Accordingly, our nominating and governance committee may consider such factors as gender, race, ethnicity, differences in professional background, experience at policy-making levels in business, finance and technology and other areas, education, skill,

and other individual qualities and attributes. The brief biographical description of each director set forth in “Proposal One: Election of Directors” below includes the primary individual experience, qualifications, attributes and skills of each of our directors that led to the conclusion that each director should serve as a member of our board of directors at this time.

PROPOSAL ONE: ELECTION OF DIRECTORS

Our board of directors currently consists of seven directors and is divided into three classes, with staggered three-year terms, pursuant to our amended and restated certificate of incorporation and our amended and restated bylaws. Directors in Class II will stand for election at the Annual Meeting. The terms of office of directors in Class III and Class I expire at our annual meetings of stockholders to be held in 2024 and 2025, respectively. Our board of directors proposes that each of the three Class II nominees named below, each of whom is currently serving as a director in Class II, be elected as a Class II director for a three-year term expiring at our 2026 annual meeting of stockholders or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal.

At the recommendation of our nominating and governance committee, our board of directors appointed George P. Scanlon as a Class II director in May 2022. Mr. Scanlon was recommended by our nominating and governance committee after coming to its attention during open discussion at a meeting thereof.

Shares represented by proxies will be voted “FOR” the election of each of the three nominees named below unless the proxy is marked to withhold authority to so vote. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for such substitute nominee as the proxy holder might determine. Each nominee has consented to being named in this Proxy Statement and to serve if elected. Proxies may not be voted for more than the three directors. Stockholders may not cumulate votes for the election of directors.

Nominees to Our Board of Directors

The nominees and their ages, occupations and lengths of service on our board of directors as of March , 2023 are provided in the table below and in the additional biographical descriptions set forth in the text below the table.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Position | | Director Since |

Class II Directors: | | | | | | |

| | | | | | |

Blake G Modersitzki (2) | | 57 | | Director | | October 2015 |

| | | | | | |

George P. Scanlon (1) | | 65 | | Director | | May 2022 |

| | | | | | |

Debora Tomlin (2) | | 54 | | Director | | December 2020 |

| | | | | | |

_______________________

(1) Member of our audit committee

(2) Member of our compensation committee

Blake G Modersitzki has served as a member of our board of directors since October 2015. Mr. Modersitzki has served as a managing director of Pelion Venture Partners from May 2002 until October

2013 when he was promoted to managing partner. He also currently serves on the boards of directors of several private companies including Deserve, Inc., since August 2016, and BusBot, Inc. (d/b/a Denim) since May 2022. Mr. Modersitzki holds a B.A. degree in Economics from Brigham Young University.

We believe that Mr. Modersitzki’s investment experience and knowledge of our industry give him the qualifications and skills to serve as a director.

George P. Scanlon has served as a member of our board of directors since May 2022. Mr. Scanlon is a private investor. From 2010 to 2013, Mr. Scanlon was the Chief Executive Officer of Fidelity National Financial, Inc. (“FNF”), after serving as its Chief Operating Officer earlier in 2010. Mr. Scanlon also served as the Executive Vice President - Finance of Fidelity National Information Services from 2009 to 2010 and the Chief Financial Officer of Fidelity National Information Services from 2008 to 2009. Prior to working at FNF, Mr. Scanlon served as the Chief Financial Officer at several companies in various industries, including real estate, technology and data services. Mr. Scanlon currently serves on the board of directors of Landstar System, Inc. since May 2017 and previously served on the boards of directors of WageWorks, Inc. from October 2018 to August 2019 and Remy International, Inc. from October 2012 to November 2015. Mr. Scanlon holds a B.B.A. degree in Accounting from University of Notre Dame and an M.B.A. from University of Miami – Herbert Business School.

We believe that Mr. Scanlon’s financial background and public company experience give him the qualifications and skills to serve as a director.

Debora Tomlin has served as a member of our board of directors since December 2020. Since March 2016, Ms. Tomlin has served on the boards of directors for LiveRamp Holdings, Inc. (f/k/a Acxiom Corporation) and for Nexla, Inc. since 2022. Ms. Tomlin has also served as an Advisor to Blumberg Capital since October 2021. Ms. Tomlin served as the Chief Marketing Officer and Head of Global Communications for Gen Digital Inc. (f/k/a NortonLifeLock, Inc.) from February 2019 to September 2020. Prior to that, Ms. Tomlin served as the Chief Marketing & Distribution Officer for CSAA Insurance Group from August 2012 to February 2019. From 2007 until 2012, Ms. Tomlin held several senior leadership positions, including Vice President of Marketing, at Capital One Financial Corp. Prior to 2007, Ms. Tomlin held several senior roles at USAA. Ms. Tomlin holds a B.A. degree in English from Siena College and a master’s degree in Political Science from North Carolina State University.

We believe that Ms. Tomlin’s technology marketing background and public company experience give her the qualifications and skills to serve as a director.

Continuing Directors

The directors who are serving for terms that end following the Annual Meeting and their ages, occupations and lengths of service on our board of directors as of March , 2023 are provided in the table below and in the additional biographical descriptions set forth in the text below the table.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Position | | Director Since |

Class III Directors: | | | | | | |

| | | | | | |

Stuart C. Harvey Jr. * (3) | | 61 | | Director | | July 2020 |

| | | | | | |

Brett White | | 60 | | Director | | July 2020 |

| | | | | | |

Class I Directors: | | | | | | |

| | | | | | |

Tyler Newton (1)(2)(3) | | 50 | | Director | | August 2017 |

| | | | | | |

David Silverman (1)(3) | | 51 | | Director | | October 2015 |

_______________________

(1) Member of our audit committee

(2) Member of our compensation committee

(3) Member of our nominating and governance committee

* Chairperson of our board of directors

Stuart C. Harvey, Jr. has served as a member of our board of directors since July 2020 and as the chairperson of our board of directors since September 2021. Mr. Harvey has also served as a senior advisor to Blackstone since April 2021. Since March 2021, Mr. Harvey has served as member of the board of directors of Portage FinTech Acquisition Corp. Mr. Harvey also serves on the boards of directors, including as chairman, of a number of privately held companies. Mr. Harvey has also served as chairman of the board of directors for Paysafe Group from April 2018 to April 2021 and as executive chairman of the board of directors for WageWorks from September 2018 to August 2019. Prior to that, Mr. Harvey served as a managing director of Piper Sandler from November 2015 to December 2017 and was president and chief operating officer from November 2016 to December 2017. Mr. Harvey holds a B.A. degree in Government from Saint John’s University, a J.D. from The George Washington University Law School and an M.B.A. from Northwestern University – Kellogg School of Management.

We believe that Mr. Harvey’s senior leadership experience and significant expertise in corporate operations and finance qualifies him to serve as a director.

Brett White has served as our Chief Executive officer since August 2022 and as a member of our board of directors since July 2020. Prior to serving as our Chief Executive Officer, Mr. White served as our President and Chief Operating Officer from April 2022 to August 2022. Prior to that, Mr. White served as the Chief Financial Officer for Mindbody, Inc. from July 2013 to December 2021 and also as its Chief Operating Officer from 2016 to 2020. Mr. White also serves as a member of the board of directors of Inspired Flight Technologies Inc., a private company, since January 2022 and as a member of the Dean Advisory Council and has served as an Entrepreneur in Residence for the Orfalea College of Business, California Polytechnic State University since April 2018. Mr. White holds a B.A. degree in Business Economics with honors and an Accounting emphasis from the University of California, Santa Barbara.

We believe that Mr. White’s financial background and public company experience give him the qualifications and skills to serve as a director.

Tyler Newton has served as a member of our board of directors since August 2017. Since December 2006, Mr. Newton has served as a partner at Catalyst Investors, a growth equity investment firm he joined in April 2000. Mr. Newton has also served on the boards of directors of a number of privately held companies and previously served on the board of directors for Mindbody, Inc. until June 2016. Mr. Newton holds a B.A. degree in Economics from Middlebury College and is a CFA Charter holder.

We believe that Mr. Newton’s growth investing experience as a director of numerous technology companies give him the qualifications and skills to serve as a director.

David Silverman has served as a member of our board of directors since October 2015. Mr. Silverman has served as a managing partner at Crosslink Capital, a venture capital firm since July 2011. Prior to joining Crosslink Capital, Mr. Silverman was a managing director at Piper Jaffray from July 2009 to July 2011 and a partner at 3i Ventures from June 2000 to July 2008. Mr. Silverman holds a B.A. degree from Dartmouth College and a J.D. degree from Stanford University.

We believe that Mr. Silverman’s experience as a venture capital investor with a focus on financial technologies, and his overall management experience, give him the qualifications and skills to serve as a director.

There are no family relationships among our directors and executive officers.

Director Compensation

Director Compensation Table

The following table provides information concerning compensation awarded to, earned by or paid to each person who served as a non‑employee member of our board of directors during the fiscal year ended December 31, 2022. Messrs. Banks and White are not included in the table below, as they each served as executive officers of Weave Communications and did not receive compensation for their services as directors while serving in their executive officer roles. The compensation received by Messrs. Banks and White for service as an executive officer or director is shown in “Executive Compensation — Summary Compensation Table” below.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($)(1) | | Stock Awards ($)(2) (3) | | Option Awards ($) | | Total ($) |

Stuart C. Harvey Jr.(5) | | 69,000 | | 151,486 | | — | | 220,486 |

Blake G Modersitzki | | 47,000 | | 151,486 | | — | | 198,486 |

Tyler Newton(4) | | 59,000 | | 151,486 | | — | | 210,486 |

George P. Scanlon(5) | | 35,122 | | 258,818 | | — | | 293,940 |

David Silverman(4) | | 49,000 | | 151,486 | | — | | 200,486 |

| Debora Tomlin | | 41,000 | | 151,486 | | — | | 192,486 |

_______________________

(1) Our non-employee directors are entitled to receive annual fees payable quarterly in arrears for service on our board of directors and committees thereof pursuant to our non-employee director compensation policy, as described further below under “—Non-Employee Director Compensation Arrangements.”

(2) The amounts reported in this column reflect the aggregate grant date fair value calculated in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718 for awards of restricted stock units

(“RSUs”) granted during the fiscal year. See Note 12 to our audited financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 for further information about the assumptions underlying the calculations. The amount reported reflects the accounting value for the RSU awards and does not correspond to the actual economic value that may be received by the non-employee directors from the RSU awards. For information regarding the number of unvested RSU awards held by each non-employee director as of December 31, 2022, see the column “Unvested Restricted Stock Units” in the table directly below.

(3) Our non‑employee directors held the following number of stock options and RSUs as of December 31, 2022:

| | | | | | | | | | | | | | |

| Name | | Shares Subject to Outstanding Stock Options | | Unvested Restricted Stock Units |

| Stuart C. Harvey Jr. | | 106,666 | | 30,358 |

| Blake G Modersitzki | | — | | 30,358 |

| Tyler Newton | | — | | — |

| George P. Scanlon | | — | | 59,362 |

| David Silverman | | — | | — |

| Debora Tomlin | | 106,666 | | 30,358 |

(4) Messrs. Newton and Silverman do not directly receive any compensation for their services as directors of the Company. Mr. Newton serves as a partner to Catalyst Investors, and Mr. Silverman is a control person of Crosslink LLC. RSUs with an aggregate grant date fair value of $151,486 per director were granted to Messrs. Newton and Silverman. Pursuant to agreements between each director and their affiliated fund, all compensation and equity awards that Messrs. Newton and Silverman receive are payable and transferred to Catalyst Investors and Crosslink LLC, respectively.

(5) Mr. Scanlon joined our board of directors in May 2022 and was awarded a grant of RSUs. Additionally, pursuant to our non-employee director compensation policy, Mr. Scanlon received prorated amounts of his fees for serving as a director and committee chair or member.

Non-Employee Director Compensation Arrangements

Prior to the adoption of our non-employee director compensation policy, we had neither a formal compensation policy nor a formal policy of reimbursing expenses incurred by our non-employee directors in connection with their service. We reimbursed our non-employee directors for reasonable expenses incurred in connection with their attendance at board of directors or committee meetings and occasionally granted stock options, typically in connection with their appointment to our board of directors.

In connection with our initial public offering in 2021, our board of directors engaged Compensia, Inc., an independent compensation consultant, to assist with the development and adoption of our non-employee director compensation policy. Our policy, which became effective on November 15, 2021, is designed to obtain and retain the services of qualified persons to serve as members of our board of directors.

The policy provides for the following annual cash retainers, which are payable quarterly in arrears and pro-rated for partial quarters of service:

Annual Cash Retainer

•Non-employee member of board of directors: $35,000.

•Non-employee Chairperson: $20,000 (in addition to non-employee member retainer above).

•Non-Employee Lead Independent Director: $15,000 (in addition to non-employee member retainer above)

Annual Committee Cash Retainer:

•Audit Committee: $20,000 for Chair and $10,000 for other members.

•Compensation Committee: $12,000 for Chair and $6,000 for other members.

•Nominating and Governance Committee: $8,000 for Chair and $4,000 for other members.

Equity Grants

The policy also provides for grants of stock options or RSUs (in the discretion of our board of directors) to purchase shares of our common stock under the 2021 Equity Incentive Plan, or 2021 Plan, to the non-employee directors upon their initial election or appointment to our board of directors and annually during their continued service thereafter. Any stock options granted will have an exercise price equal to 100% of the fair market value of our common stock on the date of grant.

Each non-employee director who is elected or appointed for the first time to our board of directors is granted an equity award with a grant date value of $300,000. The initial grant vests in three annual installments on the first, second and third anniversary of the grant date, subject to the director’s continued service through such vesting dates.

In addition, on the date of each annual meeting of our stockholders, we grant each continuing non-employee director who has served on our board of directors for at least 6 months prior to the annual meeting an equity award with a grant date value of $150,000. The annual equity award vests in full on the earlier of the one-year anniversary of the date of grant and the date of the next annual meeting of our stockholders, subject to the director’s continued service through such vesting date.

All equity awards to our non-employee directors will vest in full immediately prior to any change in control of ours.

Expense Reimbursement

Our non-employee director compensation policy also provides that we reimburse our non-employee directors for reasonable expenses incurred in connection with the performance of their duties, in accordance with our travel and expense policy as in effect from time to time.

The non-employee director compensation program is intended to provide a total compensation package that enables us to attract and retain qualified and experienced individuals to serve as directors and to align our directors’ interests with those of our stockholders.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR ALL” NOMINEES FOR THE ELECTION OF THE THREE CLASS II DIRECTORS SET FORTH IN THIS PROPOSAL ONE.

PROPOSAL TWO: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has selected PricewaterhouseCoopers LLP as our independent registered public accounting firm to perform the audit of our consolidated financial statements for the fiscal year ending December 31, 2023 and recommends that our stockholders vote for the ratification of such selection. The ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 requires the affirmative vote of a majority of the number of votes cast “FOR” and “AGAINST” the proposal. In the event that PricewaterhouseCoopers LLP is not ratified by our stockholders, the audit committee will review its future selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm.

PricewaterhouseCoopers LLP audited our financial statements for the fiscal year ended December 31, 2022. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting and they will be given an opportunity to make a statement at the Annual Meeting if they desire to do so, and will be available to respond to appropriate questions.

Independent Registered Public Accounting Firm Fees and Services

We regularly review the services and fees from our independent registered public accounting firm. These services and fees are also reviewed with our audit committee annually. In addition to performing the audit of our financial statements, PricewaterhouseCoopers LLP provided various other services during the fiscal years ended December 31, 2022 and December 31, 2021. Our audit committee has determined that PricewaterhouseCoopers LLP’s provision of these services, which are described below, does not impair PricewaterhouseCoopers LLP’s independence from us. During the years ended December 31, 2022 and December 31, 2021, fees for services provided by PricewaterhouseCoopers LLP were as follows:

| | | | | | | | | | | |

| Year Ended December 31, |

| 2022 | | 2021 |

Audit Fees(1) | $ | 1,155,716 | | $ | 2,640,000 |

Audit-Related Fees(2) | – | | – |

Tax Fees(3) | – | | – |

All Other Fees(4) | 965 | | 964 |

| Total Fees | $ | 1,156,681 | | $ | 2,640,964 |

_______________________

(1) “Audit Fees” represents fees for professional services rendered in connection with the audit of our financial statements, including audited financial statements presented in our Annual Report on Form 10‑K, review of the interim financial statements included in our quarterly reports and services normally provided in connection with regulatory filings. Audit fees in 2022 include fees related to the annual audit of our financial statements and review of interim financial statements included in our quarterly reports. Included in 2021 Audit fees is an aggregate of $1,495,000 of fees billed in connection with our initial public offering, which closed in 2021.

(2) “Audit-Related Fees” represents fees for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements, and other accounting and financial reporting consultation or research work necessary to comply with financial accounting and reporting standards.

(3) “Tax Fees” represents fees for tax compliance and advice. Tax advice fees encompass a variety of permissible services, including technical tax advice related to federal and state income tax matters; assistance with sales tax; and assistance with tax audits.

(4) “All Other Fees” represents access fees to accounting, financial and disclosure resources.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our audit committee’s policy is to pre‑approve all audit and permissible non‑audit services provided by our independent registered public accounting firm, the scope of services provided by our independent registered public accounting firm and the fees for the services to be performed. These services may include audit services, audit‑related services, tax services and other services. Pre‑approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent registered public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by our independent registered public accounting firm in accordance with this pre‑approval, and the fees for the services performed to date.

All of the services relating to the fees described in the table above were approved by our audit committee.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL TWO.

PROPOSAL THREE: APPROVAL OF AN AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO INCLUDE AN OFFICER EXCULPATION PROVISION